IOB and ONGC fight through Semifinals

IOB and ONGC fight through Semifinals to face each other in the Finals at the 32nd Federation Cup in Chittoor

Bengaluru, 5th May 2018: The 32nd Federation Cup is going on at the District Sports Authority in Chittoor, Andhra Pradesh on 1st May. The best club/state teams from the top 8 states in both the Men’s and Women’s category with addition of the hosts Andhra Pradesh are participating in this 6 day long tournament. The championship is being organised by the Basketball Association in Andhra Pradesh under the aegis of the Basketball Federation of India.

It will be last years finals rematch in the Men’s section as IOB Chennai and ONGC Dehradun will face each other again. IOB Chennai faced the Customs and excise, Cochin in the semi finals which was thought to be a one sided affair but Cochin shocked everyone in the first two quarters as they managed to gain a one point lead at half time. But the experience of Rikin Pethani and some excellent plays from G Sivabalan who has been IOBs highest scorer and their best player so far in the tournament took the game away form Cochin in the second half and confirmed a seat in the finals. The last Semi-Final of the day saw the defending champions take a victory over the energetic MEG team in a very competitive game which went to overtime. The current Indian team captain Yadwinder Singh showed his expertise in the last few minutes of the game and sealed their finals play with a clutch shot with only few seconds left in the game.

DAY-5:

MEN:

IOB(Sivabalan 26 pts, Rikin 23 pts, Prasanna 17pts) bt Customs,Cochin(Shinu 20 pts, Bony 17 pts) 87-74[19-18, 21-23, 26-15, 21-18]

ONGC(Yadwinder 21pts, Muin Bek 19pts) bt MEG(Mayur 24 pts, Rahul 15 pts) 68-65[20-19, 13-15, 15-4, 10-20, 10-7]

WOMEN:

Tamil Nadu(Pushpa 28 pts, Srividhya 20 pts) bt Eastern Railways(Madhu 24 pts, Libina 20 pts) 82-64[26-17, 15-14, 16-15, 25-18]

Kerala(Jeena 20 pts, Rojamol 14 pts) bt Maharashtra(Sakshi 14 pts, Sruthi 9pts) 60-42[13-12, 20-09, 13-12, 14-09]

6TH MAY, 2018

| Team ‘A’ | V/s | Team ‘B’ | Group | Time | Court No. | |

| 3rd Place | Customs, Cochin | V/s | MEG | MEN | 04.30 PM | 1 |

| 3rd Place | Maharashtra | V/s | Eastern Railways | WOMEN | 04.30 PM | 2 |

| Final | Kerala | V/s | Tamil Nadu | WOMEN | 05.45 PM | 1 |

| Final | ONGC Dehradun | V/s | IOB Chennai | MEN | 07.00 PM | 1 |

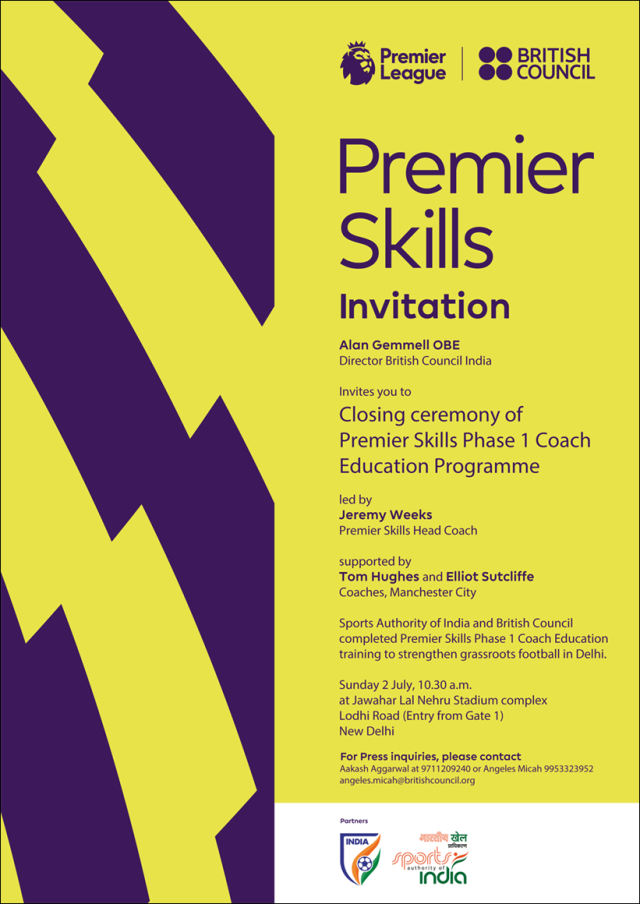

UKIndia2017 Premier League Closing Ceremony July 02 at 10.30 AM

Thanks and regards

Angeles Micah | Brand Manager, India |

British Council Division | British High Commission | 17, Kasturba Gandhi Marg | New Delhi – 110001 | India |

British Council Division | British High Commission | 17, Kasturba Gandhi Marg | New Delhi – 110001 | India |

T +00 91 11 42199000 | D + 00 91 11 41497240 | F +00 91 11 23357709 | M + 00 91 0 9953323952

E angeles.micah@in.britishcouncil.org

E angeles.micah@in.britishcouncil.org

British Council India | UKIndia2017 celebrate connect inspire

INVITE FOR BOOK DISCUSSION

INVITE FOR BOOK DISCUSSION ON 8 MAY AT 6.30 PM

Dear Friend

—

Dr.Mahalingam M

Research Fellow

Centre for Policy Analysis

C-17, Second Floor,

Green Park Extension,

New Delhi – 110016

Ph:- 011-26176992

Website: www.cpadehli.org

RBI decides to set up a new system

RBI decides to set up a new system for monitoring foreign investment limits in listed Indian companies

Attention of Authorised Dealer Category-I (AD Category-I) banks is invited by RBI to Foreign Exchange Management (Transfer or Issue of Security by a person Resident outside India) Regulations, 2017 notified vide Notification No. FEMA 20(R)/2017-RB dated November 07, 2017 and as amended from time to time, in terms of which the onus of compliance with the sectoral/ statutory caps on foreign investment lies with the Indian investee company.

Currently, Reserve Bank of India receives data on investment made by Foreign Portfolio Investors (FPI) and Non-resident Indians (NRI) on stock exchanges from the custodian banks and Authorised Dealer Banks for their respective clients, based on which restrictions beyond a threshold limit is imposed on FPI/ NRI investment in listed Indian companies.

In order to enable listed Indian companies to ensure compliance with the various foreign investment limits, Reserve Bank in consultation with Securities and Exchange Board of India (SEBI), has decided to put in place a new system for monitoring foreign investment limits, for which the necessary infrastructure and systems for operationalizing the monitoring mechanism, shall be made available by the depositories. The same has been notified by SEBI vide Circular-IMD/FPIC/CIR/P/2018/61 dated April 05, 2018 read with Circular- IMD/FPIC/CIR/P/2018/74 dated April 27, 2018.

In terms of para 6 of Annexure A of the circular dated April 05, 2018, all listed Indian companies are required to provide the specified data/ information on foreign investment to the depositories. The requisite information may be provided before May 15, 2018. The listed Indian companies, in non-compliance with the above instructions will not be able to receive foreign investment and will be non-compliant with Foreign Exchange Management Act, 1999 (FEMA) and regulations made there under.

All Authorised Dealer Banks are advised to instruct their clients and respective Indian companies, about the system requirement at para 4 of this circular. Further, upon implementation of the new monitoring system, all Authorised Dealer banks would be required to provide the details of investment made by their respective NRI clients to the depositories in the format as provided by the depositories/ SEBI. In addition, the reporting to Reserve Bank in the existing system, viz., LEC (NRI) and LEC (FII), would continue.

AD Category-I banks may bring the contents of this circular to the notice of their customers / constituents concerned. The directions contained in this circular have been issued under sections 10(4) and 11(1) of the Foreign Exchange Management Act (FEMA), 1999 (42 of 1999) and are without prejudice to permissions / approvals, if any, required under any other law.

Interaction with Mr. Serhii Sukhomlyn, Mayor of Zhytomyr Ukraine

Thank you for confirming your presence for the Interaction with Mr. Serhii Sukhomlyn, Mayor of Zhytomyr Ukraine on 7 May 2018 from 1000 hrs onwards at the Hall No 3 Pravasi Bhartiya Kendra (PBK), Chanakyapuri.

The objective of Mayor’s visit to India is look for business prospects in the fields of IT, solar energy, and infrastructure projects among others. A brief profile of Mayor is enclosed for your reference.

Request you to arrive before 10 AM. In case of anything, please do not hesitate to call/text me at 8860030312.

Looking forward to meeting you on Monday, May 7th at 10 AM.

Important announcements and approvals in Board Meeting of PFRDA

Pension Fund Regulatory and Development Authority (PFRDA) is established by the Government of India for regulation and development of Pension Sector in order to protect the old age income security of subscribers. PFRDA takes various initiatives from time to time in order to simplify and improve the operational issues in National Pension System (NPS) like new functionality development under NPS architecture, simplification of account opening, withdrawal, grievance management etc.

In this regard, during the recently held Board Meeting some important decisions were taken to improve the operational and regulation issues in National Pension System (NPS). Some of the decisions taken in the Board Meeting are as follows:

· Budget announcement- Rating criteria for investments- Proposal on changing the investment grade rating from ‘AA’ to ‘A’ for corporate bonds was approved. The change is subject to a cap on investments in ‘A’ rated bonds to be not more than 10% of the overall Corporate Bond portfolio of the Pension Funds. This initiative will enlarge the scope of investment for the Fund Managers while ensuring credit quality.

· Introduction of a Common Stewardship Code: The proposal on adoption of Common Stewardship Code, as a measure of good Corporate Governance, was approved. Further, it was also approved that the Principles enumerated in such code shall be circulated to all Pension Funds for compliance and implementation. Adoption of these Principles by Pension Funds will improve their engagement with investee companies and benefit subscribers.

· Modification in Partial Withdrawal rules under NPS: Partial withdrawals will now be allowed to NPS subscribers who wish to improve their employability or acquire new skills by pursuing higher education/ acquiring professional and technical qualifications. Further, individual NPS subscribers who wish to set up a new business/ acquire new business will also be allowed to make partial withdrawals from his contributions. Other terms applicable to partial withdrawals will remain unchanged.

· Increasing cap on equity investment in active choice to 75% from current 50% for Private Sector Subscribers: Presently there is a cap of 50% on equity investment under active choice in NPS. The proposal on increasing cap on equity investment in active choice to 75% from currently 50% has been approved by the Board. However, it comes with a clause of tapering of the equity allocation after the age of 50 years.

Currently, NPS and Atal Pension Yojna (APY) have a cumulative subscriber base of over 2.13 crore with total Asset Under Management (AUM) of more than Rs. 2.38 lakh crore.

CM Haryana visiting Israel and Britain

CM Haryana Mr Mohan Lal Khattar is visiting Israel & Britain to rope in Investment and during questions hours Media asked Is tour on govt expenses on this tour ,CM quickly added we r better than Punjab they are unable to pay salaries to their employees. Foreign tours for exploring collaboration for agriculture ,Water treatment, Security, Aviation, space, security and investment are the the sectors for which the state is seeking collaboration from Britain and Israel.

Round Table with Chair IBBI & stakeholders

Round Table Industry Expert Meeting

Issues In Implementation Of IB Code 2016

08th May 2018, Hotel The Claridges, New Delhi.

Round Table Session Chairman

Dr. M.S. Sahoo, Chairperson, Insolvency and Bankruptcy Board of India (IBBI)

Greetings From ASSOCHAM,

The IB Code 2016 (“The Code”) is a landmark piece of legislation amongst a horde of path breaking reforms brought in by the current Government. This single piece of legislation has allowed us to jump several places in the world ranking on ease of resolving insolvencies. The intent of the Code has been clearly based out of the Bankruptcy Law Reforms Committee Report of November 2015 which laid the foundation for the IB Code. Based on BLRC recommendations, The IB Code empowers the financial creditors / lenders (Committee of Creditors (CoC)) with exclusive rights and privileges in the CIRP and authorizes them solely to decide the fate of the corporate debtor and its other stakeholders such as the unsecured creditors, equity shareholders, employees and workers, etc…. whether revival or liquidation. However, While the BLRC Report specifically highlights the duties and responsibilities of the CoC members and its reasoning’s behind putting all the powers in the hands of financial creditors, the same is missing from the final piece of IB Code or its regulations. Based on last 15 months of the functioning of IB Code, it would help if the Board could issue Regulations providing for the duties and responsibilities of COC members making them accountable for their decisions which they take during the course of the resolution process since they owe a fiduciary duty to all the other stakeholders as well.

To address these issues in the interest of the economic development of the nation and to prevent liquidation of the viable companies, an immediate intervention is required by way of issue of urgent guidelines or regulations to regulate the CAC members.

In this backdrop, ASSOCHAM with Insolvency & Bankruptcy Board of India (IBBI) is conducting a round table meeting on IBC for discussing some of the major challenges and issues being faced under the IB Code 2016 and a possible alternative plan. The round table meeting will be addressing the concerns over the Ordinance on IB Code 2016, No incentive to Banks, Accountability, IRPs and many other key issues.

Target Audience:-

· Insolvency Professionals

· Banks

· Financial Institutions

· Government Officials and Regulators

· Corporates

· Entrepreneurs

· Real Estate Investors

· Consultants

· Tax Consultants and CAs

· Asset Reconstruction Companies

· Law Firms

Key Areas of Discussions:-

· Proposal for Invoking Personal Guarantee in Insolvency Resolution

· Staggering of MTM Hit

· Ordinance on IB Code 2016

· No incentive to Banks

· Accountability

· IRPs

· Quorum & Voting at CoCs

· Dissenting Financial Creditors

· Payment to Operational Creditors

The deliberations at this highly interactive round table session will serve as a game-changer and help authorities in addressing the apprehensions and issues raised by different stakeholders.

We are pleased to inform you that Dr. M.S. Sahoo, Chairperson, Insolvency and Bankruptcy Board of India (IBBI) has very kindly agreed to be the session chairman for this round table meeting.

In this regard, We would like to invite you as per the attached registration form to attend the round table meeting schedule to be held on 08th May 2018 at Hotel The Claridges, New Delhi

Your participation would add immense value to the content of the conference.

We look forward for your kind confirmation.

Sincerely,

Kushagra Joshi

The Associated Chambers of Commerce and Industry of India

Banking & Financial Services,

5, Sardar Patel Marg, Chanakyapuri,

New Delhi – 110021

Mob:+91-8447365357

Phone: +91- 11- 46550624

Fax: +91- 11- 46536481/82

Delhi Air Polluting deliberation at CPR

Public debate over the quality of Delhi’s air reliably spikes every winter, along with the readings from air quality monitors. However, public discussion tends to rapidly taper off, even as the air quality remains consistently bad.

The Initiative on Climate, Energy and Environment (ICEE) at the Centre for Policy Research (CPR) is organising a seminar series – Clearing the Air? Seminar Series on Delhi’s Air Pollution – to promote sustained and informed public understanding around the data, impacts, sources and policy challenges involved in clearing Delhi’s air. While we focus on the Delhi context, the series also reflects on the fact that the problem extends far beyond Delhi. The seminar series presents the work of experts in a range of areas, to help promote informed public discussion about what changes are needed, what is possible, and how to get it done. Clearing the air in terms of knowledge and public information, we hope, will make a small contribution toward actually clearing Delhi’s air. ICEE invites you to the eighth event in this series. A panel discussion on ‘Power plants as a source of Air Pollution in India’

Vinuta Gopal, Co-founder & Director, Asar Social Impact Advisors

Priyavrat Bhati, Programme Director, Energy, Centre for Science & Environment Ritwick Dutta, Environmental Lawyer & Founder, Legal Initiative of Forest & Environment Moderator: Shibani Ghosh, Fellow, Centre for Policy Research |

Friday, 11 May 2018, 4:00 – 5:30 p.m.

|

|

| Image Source |

As part of this seminar series, we have looked at three sources of air pollution: transport, crop burning, and municipal solid waste, and we now turn to a fourth significant source of air pollutants in the country – coal-based thermal power plants. They are responsible for the dramatic rise in pollutants such as SO2 and NOx in the country, particularly in industrial hotspots.

Power plant-specific emission standards for PM, SO2, NOx and mercury, introduced by the Ministry of Environment, Forests and Climate Change in 2015, were to be complied with in two years. By some estimates these could have reduced emissions from power plants by 70-85%. However, the Ministry moved the Supreme Court to relax its own deadline by five years, claiming that the standards were not attainable in two years. As coal-based power plants generate about 75% of India’s electricity, regulation of emissions from power plants needs urgent attention. The panel will explore various aspects of this issue: what is the nature and scale of the problem; what is the governing regulatory eco-system; and what was the process of formulation of the 2015 emission norms? It will also deliberate the key challenges – political, economic and technical – in reducing power plant emissions and what is the role of the courts, particularly the Supreme Court, in regulating pollution from power plants. About the Panelists: Vinuta Gopal is a co-founder and director at Asar Social Impact Advisors Pvt Ltd, a consultancy company set up to provide advice, support and research data to forge an enabling environment for change on social and environmental issues. She has more than 15 years of experience in a campaigning and advocacy and led the climate and energy team in Greenpeace India during its formative years, leading them to some significant victories and new areas of work. During a difficult period in Greenpeace India, she also headed the organisation as the interim Executive Director and Program Director. Priyavrat Bhati is Programme Director – Energy at Centre for Science and Environment, New Delhi. He led the team that published a study of the coal-based power sector, Heat on Power, which proposed several policy reforms and tighter pollution norms to improve the environmental and operating performance of the sector. He has closely worked with the Ministry of Environment, Forest and Climate Change, and central regulators to draft new environment standards for the thermal power sector and to improve the monitoring and compliance framework. He has also advised policy makers on energy and environment issues in other countries including Indonesia, South Africa and Tanzania. Prior to joining CSE, he spent over two decades in investment banking. Ritwick Dutta is an environmental lawyer and founder of the Legal Initiative of Forest and Environment (LIFE), an organisation working on issues of transparency and accountability in the field of environment protection. He has been involved in several environmental cases challenging regulatory approvals granted to projects and highlighting environmental impacts of development activities. Recently, he has been asked by the Supreme Court to assist it on the case relating to power plant pollution standards. The discussion will be moderated by Shibani Ghosh, Fellow, Centre for Policy Research. |

No comments:

Post a Comment